Fintech – The Future of Finance

History of FinTech

FinTech is a catchall term for technology that aspires to automate and enhance financial services. With the use of algorithms and software running on computers and smartphones, FinTech enables businesses and people to manage their financial operations. When it first appeared in the early twenty-first century, the word "FinTech" was used to refer to the technology used, especially in the backend of financial services. However, there has been a movement in recent years toward consumer-focused technology. FinTech now encompasses a wide range of professions and fields, including management, retail banking, fundraising, and education.

The FinTech industry is advancing toward a bright and expanding future by creating and launching ground-breaking technologies for FinTech users. There has never been a better moment to get a master's degree in FinTech.

Influences on Innovation

When we consider the development of FinTech, a number of elements are at play. Nearly all of our daily activities have altered as a result of technological improvements. IoT, AI, blockchain, and cloud technologies are the main engines behind FinTech businesses.

Consumer behavior, particularly among Gen X, Y, and Z, has changed, and certain markets' pre-existing financial infrastructures are simply unable to keep up with social developments, allowing new competitors with access to technology to enter the market. As technology has advanced, entrance barriers have decreased, compelling financial institutions to adapt or risk being left behind. It has made room for fresh challenger startups that are focusing on customers with distinct demands and behaviors, like Monzo in the banking sector.

Companies are able to see trends more rapidly and adapt to them because of increased access to information made possible by analytics, AI, and cloud computing. We will undoubtedly see many more breakthroughs in the near future because investment in the field has been enormous and is expanding quickly.

A Fresh Perspective on Money

FinTech has altered how people view money and value exchange in a real-time, digital world. "Cashless" businesses are now prevalent, forcing consumers who had been hesitant to adopt the habit of digital transactions to do so. Governments are now debating whether such practices are discriminatory or simply represent progress.

The first stage is to require people to pay for products and services electronically rather than with cash. In order to test their new idea, tech giant Amazon is leading the way by combining an online shopping account with a conventional at-person shopping experience in nine convenience stores without cashiers. As soon as customers leave the store with the things they need, their Amazon account is instantly charged. These ideas will probably influence the future of shopping.

Another example of a FinTech innovation that many modern customers have accepted is the ability to make payments using smartphones or smartwatches. Even while PayPal has been around for a while, relative newcomers like Venmo, TransferWise, and Zelle are changing the way we exchange money for everyday transactions like splitting a bill and selling things to friends. In addition, more people are creating straightforward ways for people who care about a person, circumstance, or cause to donate with a few clicks, thanks to the growth of crowdfunding websites like GoFundMe.

The development of digital currencies like Bitcoin and the blockchain-based record-keeping technology that underpins them is a phenomenon that is far less well-known but ultimately very likely more inventive. Although it has not yet been fully incorporated into our daily lives, it has the potential to fundamentally alter how we manage financial risk as well as how we pay, save, and borrow money.

Using Fintech to Improve Financial Services

Some of the technologies influencing change in how customers engage with the businesses they buy from and how they handle their money are IoT, AI, blockchain, and cloud computing. FinTech may be viewed as a disruptor of the traditional financial services sector, but those who are embracing technological innovation are changing the sector from the outside in and prospering where the old companies have failed. With the aim of simplifying and improving money management, FinTech businesses are now dominating the sector and developing a wide range of innovative financial goods and services.

1) Money Borrowing and Lending : Obtaining finances has become much more transparent and decentralised, and alternatives to the conventional method of borrowing money from a bank through loans and mortgages, such as crowdfunding and peer-to-peer lending, are now available.

2) Financial Markets : Despite being created in a pre-digital era, these markets are currently seeing significant upheaval and innovation. The use of algorithmic or automated trading on stock exchanges is made possible by machine learning and artificial intelligence (AI). To forecast potential future occurrences, prediction markets like Augur compile data using connections and network intelligence. Individuals now have access to trading facilities that were previously exclusively open to institutional investors, and thanks to this new access.

3) Asset Management : The automation of data processing and analytical tools and technology, particularly in asset rebalancing, has risen. Algorithms are also being used by cloud-based, robo-advisory-enabled platforms to give customers investing and asset management advice.

4) Regtech : With developments occurring so quickly, it is challenging for many organisations to compete while adhering to the regulatory frameworks specific to their industries. Regtech systems track transactions and look for anomalies that can point to fraud using big data and machine learning. Risks are reduced by seeing possible threats in real time, and data breaches are frequently rectified or totally averted.

New Markets For Consumers

Through the use of mobile devices, FinTech is enabling financial services, making the providers explore new markets and enabling customers in places with limited alternatives to obtain services that were previously unavailable. FinTech firms are able to reach and profit from areas that have up to now been underserved, notably in Asia and the Southern Hemisphere, thanks to access to underbanked and unbanked individuals.

Conclusion

Even if developments in the field of FinTech have been occurring at a breakneck pace, we have only begun to scratch the surface of what is both feasible and likely to occur in the next few years. By making it simple to trade, bank, and swap money without the requirement for in-person connection, FinTech is not exaggerating when it is said that technology is actually transforming our lives and behaviors.

Share This Blog, Choose Your Platform!

RELATED BLOGS

Blog Summary Firebird Institute's PGDM program ai...

Read More

About Firebird The Firebird Institute of Research...

Read More

Introduction The students of Firebird Institute o...

Read More

In the rapidly evolving world of business, choosin...

Read More

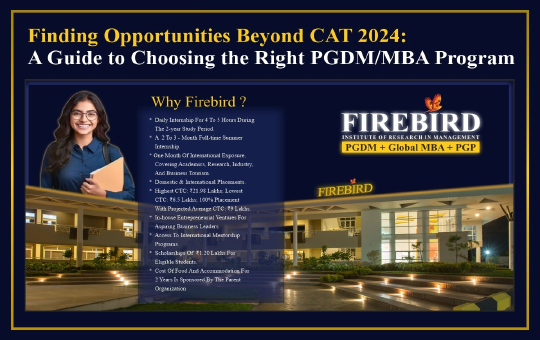

The CAT 2024 results have been officially anno...

Read More

A Guide to Choosing the Right PGDM/GLOBAL MBA Pro...

Read More

Why Pursue a PGDM/GLOBAL MBA Degree in 2025? As ...

Read More

The closing ceremony at Multimedia University (MM...

Read More

As one of the top PGDM/Global MBA colleges in Coi...

Read More

Firebird Institute of Research in Management, rec...

Read More

A Grand Procession: Setting the Tone The Convocat...

Read More

The Firebird Institute of Research in Management, ...

Read More

Overview The Firebird Institute of Research in Ma...

Read More

Firebird Students Head to Multimedia University fo...

Read More

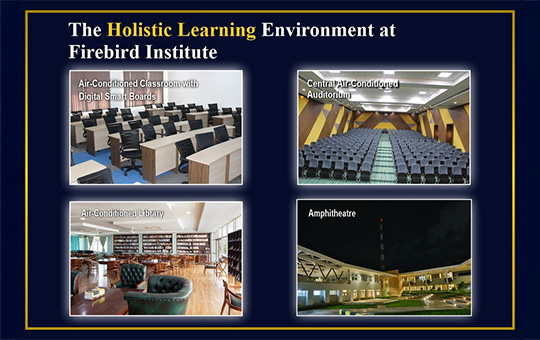

A Campus That Combines Nature with World-Class In...

Read More

The vibrant energy of Firebird Institute of Resear...

Read More

A Celebration of Academic Excellence and Cultural ...

Read More

About Firebird Firebird Institute of Research in ...

Read More

Overview Firebird Institute of Research in Manage...

Read More

Overview The Firebird Institute of Research in Ma...

Read More

Overview The Firebird Institute of Research in Ma...

Read More

Overview The convocation ceremony at Firebird Ins...

Read More

Firebird Institute of Research in Management: CEO ...

Read More

Overview In today's dynamic world, the boundaries...

Read More

Exploring the Comprehensive Support Services for F...

Read More

Overview: At the Firebird Institute of Research...

Read More

Overview: In today’s dynamic business environ...

Read More

Comments